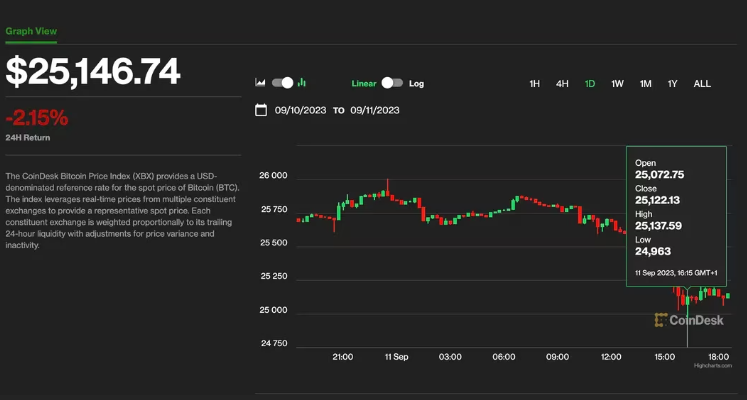

Crypto markets tumbled Monday as traders got spooked by the potential selling pressure from bankrupt exchange FTX. Bitcoin (BTC) fell more than 2% and briefly dipped to as low as $24,963 during U.S. morning hours, its first time below the $25,000 level since mid-June. It has pared some of those losses since, now trading at around $25,140, 2.6% lower in the last 24 hours.

Ether (ETH), the second largest crypto asset by market capitalization, was down 3.2% on the day, changing hands at $1,560.

Altcoins hit hardest on FTX worry

Alternative cryptocurrencies – altcoins – are underperforming, led by Solana’s SOL with a more than 8% decline. Toncoin’s TON and layer 2 Arbitrum’s ARB tumbled similar amounts and Ripple’s XRP suffered a 5% loss.

The downward action happened as market participants were digesting the possibility of FTX securing approval from bankruptcy court to sell assets from its $3.4 billion of cryptocurrency holdings.

Singapore-based digital asset services provider Matrixport noted in a Monday market report that “an altcoin crash is coming” as FTX might start selling tokens as early as this week.

SOL is facing the most significant pressure, as FTX holds $1.16 billion worth of that token, CoinDesk reported earlier Monday. That’s nearly 16% of its outstanding supply, according to CoinDesk Indices data.

The bankrupt exchange also holds $560 million in BTC and hundreds of millions in lesser known illiquid micro-cap tokens. The firm has already tapped digital asset investment firm Galaxy to assist with the sales.

Ethereum (ETH), Solana (SOL) price outlook

Matrixport said that FTX’s crypto sales could weigh on altcoin prices for the rest of the year.

SOL broke down from the $19 level with increasing volume, Matrixport noted, calling the move “concerning” and potentially opening the way for further declines to next support levels at $15 and then $10.

ETH also could drop further as the protocol’s “revenue growth disappoints,” according to the firm.

“Technically, the break of $1,650 makes us extremely cautious about ETH here, and we could even envision a scenario where prices materially drop lower into year-end,” said Matrixport. “A decline below $1,500 could bring back the idea that ETH could decline to $1,000.”